Growth Lessons for Early-Stage Fintech Infrastructure Companies

Impedance matching in payments. Build trust, show competence. The importance of mental health for founders.

I recently joined my friend, Brian Scordato, on his podcast, Idea to Startup, where we talked about growth tactics for early-stage startups. Check out a short clip here or watch / listen to the full episode later. Brian’s a great interviewer and I highly recommend listening to some of his other episodes. Most of the lessons are applicable to any early-stage startup, but I think a few are specifically relevant to payments infrastructure companies.

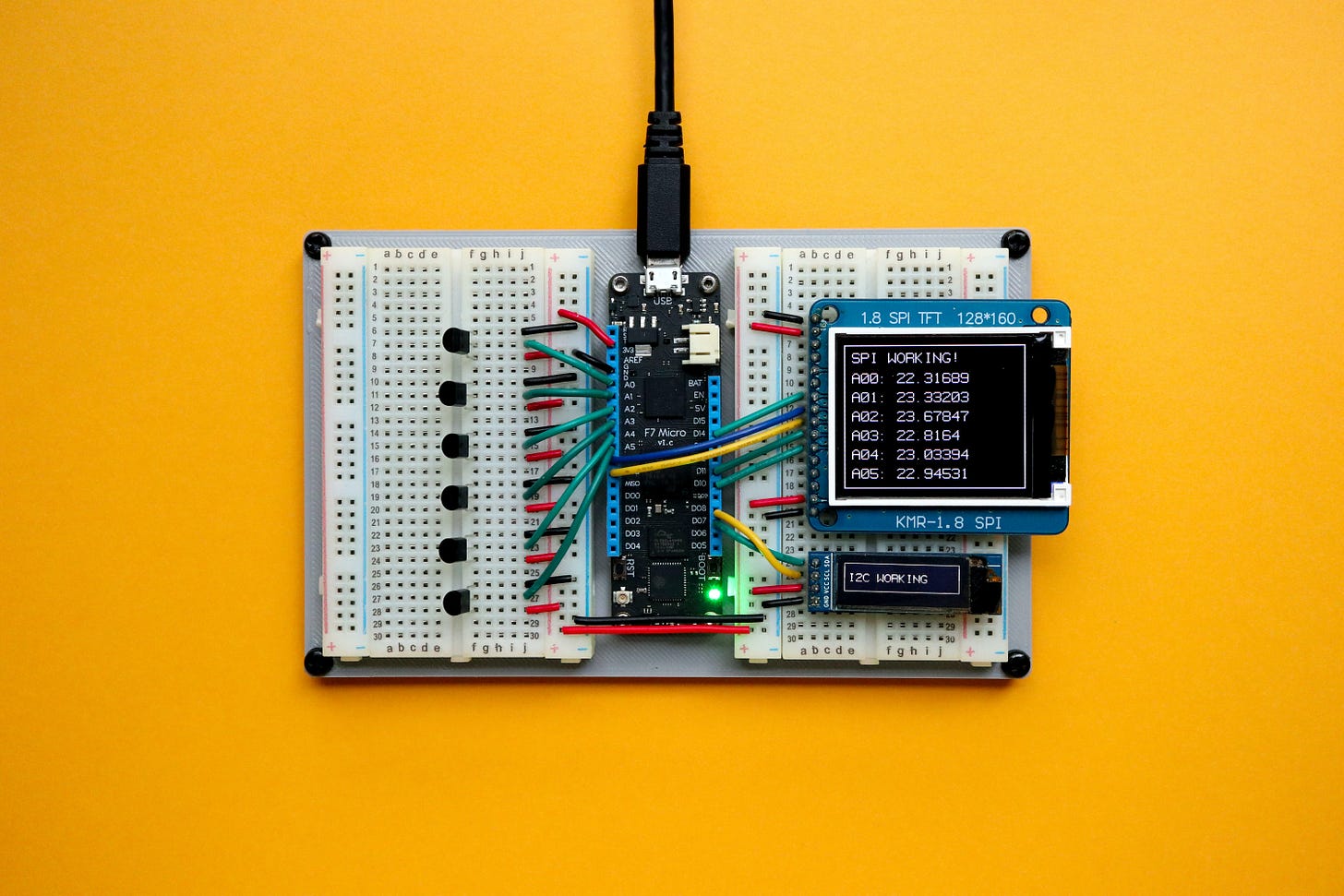

At one point (14:24), Brian asks how we got our early customers at Balanced, a payments company, I co-founded in 2011. I started off my answer by trying to explain impedance matching, an electrical engineering concept I learned in college. That part of the answer didn’t make much sense, so I wanted to try explaining again here in more simple terms.

Impedance Matching in Payments

When designing electronics for efficient data transfer, it’s important that the impedance of your source (where the signal comes from) and your load (where the signal is going) match in order to have maximum data transfer. Too much impedance in the source and there’s not enough power transfer. Too much impedance in the load and you get signal reflection and data corruption. I won’t torture this metaphor any further but I see a similar size-matching playing out among the large, modern payments processors (Adyen, Stripe, Checkout) and their early customers.

Adyen

If you read last week’s batch, you may have caught my note that the founders of Adyen sold their first company, Bibit, to RBS WorldPay in 2004. When they started Adyen a few years later, they had a cheat code: they were more credible to early customers, had existing connections to prospects, and knew how to build and scale stable payments infrastructure. It still took a while but there’s a reason Adyen is better at closing enterprise-grade customers than the other modern processors—they’ve been doing it since day one.

Stripe

Stripe had to match the size of their customers. They took on small, developer-led merchants, and then, as those early customers (e.g. Instacart, DoorDash) took off, Stripe grew with them, investing in the stability, features, and international expansion needed to support large, growing customers. Now, Stripe has the benefit of supporting large customers (that weren’t always large), which they can use to acquire eve bigger customers. For more on this concept, check out 💰 Batch #4: Stripe, Amazon, and The Compounding Nature of Digital Infrastructure.

Checkout

Checkout seems to have focused on crypto-related customers in order to gain volume quickly. A few weeks ago, I covered how this strategy has led to a “crypto conundrum” for Checkout as their payment volume and take rate seem to have fallen with the rest of the crypto industry. But the point remains, targetting customers that are not being served by many providers is a valid strategy to build payment volume and revenue. In Checkout’s case, they focused on high-risk merchants in crypto. At my previous company, Finix, we started off by focusing on payment facilitators, before becoming a payment facilitator ourselves and serving a broader customer base.

Some of this matching between processors and merchants occur naturally. But I wanted to share one point of caution for fintech infrastructure companies: be careful saying yes to everything a larger customer asks of you. Of course, you want to say yes to big customers that can bring a lot of revenue and social proof but there’s a risk of essentially becoming an outsourced development shop for them. I highly recommend reading last week’s Net Interest about FIS spinning out Worldpay. In it, are some great quotes from Adyen’s CEO, Pieter von der Does, about why Adyen insists on building a “single platform.” When they build a capability into their platform, it’s available to every customer across the platform via a single integration. Custom, one-off builds can quickly take an early-stage infrastructure company off course and is often not worth it.

Build Trust, Show Competence

All companies must attract and retain customers in order to grow but not all companies are vital like infrastructure companies. In their early days, payment infrastructure providers—like my previous company, Balanced—had to convince customers to trust them with revenue-driving infrastructure and securely handle sensitive customer data. If a service that you use to post snarky messages is down for a few hours, it’s annoying. If your payments processor is down or makes a mistake, you have a much more serious problem that could have long-term implications. As a result, it’s especially important for payment infrastructure companies to gain trust by investing in social proof and evidencing competence to early customers. At Balanced, we invested in a number of tactics to acquire early customers:

We used the frequency and accountability inherent within Y Combinator, a startup accelerator my co-founders went through in 2011, to convince other early-stage customers to use our API to move money for their very young startups.

We convinced prominent figures in tech to invest in Balanced. We specifically pursued investors—Brian Chesky, CEO of Airbnb; Yishan Wong, CEO of Reddit; Jeff Jordan of a16z—who had experience running platforms and marketplaces, which was our target customer.

We operated Balanced as an “open company,” making everything from product roadmap, pricing decisions, customer support channels, etc all open and publicly available by default. Customers felt that Balanced had nothing to hide and could therefore trust us more easily. Customers could also more easily evaluate our competence because our product development process was happening in public.

We actively engaged with our community on forums like Hacker News, StackOverflow, Quora, and our own GitHub repositories. Sharing posts like the ones below showed current and future customers that they could trust us to ship useful products at a rapid clip. If we didn’t have what they needed now we:

When Stripe, another YC-backed company, launched their marketplace product to compete directly with Balanced, we could no longer rely on the YC trust factor, so we focused on marketing tactics like the ones below to showcase our credibility vs. Stripe:

We asked customers to write blog posts about why they chose Balanced over Stripe.

We got profiled in Forbes and GitHub produced a video about how Balanced was using their tools (can’t find the link).

The basic idea is that for early-stage payments infrastructure companies, it’s important to build trust with and evidence competence to early customers. This can be done using a variety of tactics: community, communication standards, investor endorsements, public relations, marketing, and more.

Mental Health for Founders

On the Idea to Startup podcast, I also shared why investing in your mental health is so important as a founder. For me, a lot of my mental health comes down to building healthy physical habits and investing in fulfilling relationships. Building fintech infrastructure takes a long time (I spent nearly a decade working on the same problem), so it’s important to have the physical and emotional reserves necessary to slog it out. Here’s a brief clip from the recording.

Cutoff Time

Cutoff Time is a section of Batch Processing that includes links to news and ideas I found interesting but decided not to write about in this batch:

F-Prime released their 2023 State of Fintech by Abdul Abdirahman

Lago, an open-source usage billing engine, has “launched”, taking on Stripe Billing, Chargebee, and Recurly.

Interchange Is a Burning Platform by Matt Brown

This batch was powered by:

Any sort of new feature development stories would be fascinating to hear about. How decisions were made, trade offs weighed, etc.

Really enjoyed the “Build Trust, Show Competence” section! A lot of great takeaway points for any business, not just fintech startups.