Why is PayPal interested in buying Pinterest?

PayPal is attempting to build a deconstructed sales funnel for the internet.

PayPal is in late-stage talks to acquire Pinterest for as much as $45B, or about 15% of the payment giant’s enterprise value. As my friend Matt Austin astutely observed about the size of the deal: “that’s a big meatball!” So why is PayPal interested in shelling out so much for Pinterest?

To answer these questions, I looked through PayPal’s recent acquisitions and product announcements to see what they might be up to. As I did, a clear shape started to form in my mind of what the assembled pieces could turn into. I think PayPal is trying to build a sales funnel, not just for one website, but for the entire internet.

Sales Funnels and Growth Loops

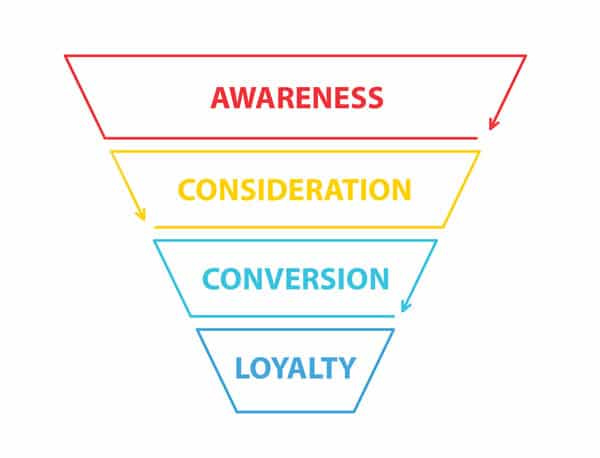

The sales funnel (often called a marketing funnel) was invented in 1898 and is considered the first formal marketing theory ever created. The idea is that at the top of the funnel someone who has never heard of your product or brand becomes aware of you for the first time. Some subset of that group will consider buying your product. Then, some smaller subset will actually purchase your product or service. Finally, some subset of customers will remain loyal and purchase from you in the future. The number of users gets smaller and smaller at each step, which is why it’s considered a funnel.

For sustained growth, you need to retain customers and continue to attract more and more customers into the top of the funnel. One trick internet companies, like Pinterest, figured out is that you can use existing customers to increase the chances of finding and retaining new customers. This is why more modern versions of the sales funnel concept are envisioned as “growth loops” instead:

Pinterest is not the next eBay

One theory I saw on Twitter suggested that PayPal is trying to find its next eBay. This would allow PayPal to see the entire sales funnel from top to bottom on a commerce property it fully owns. This isn’t a wild idea. Recall that online marketplace pioneer eBay actually owned PayPal from 2002 to 2015. PayPal buying an online marketplace like eBay (or more likely Etsy) would give PayPal a new property that could produce more gross payments volume (GPV) and revenue. But Pinterest is not a shopping destination like eBay or Etsy.

Instead, Pinterest is a place where shopping begins for 450M+ users. And there is a TON of shopping intent on Pinterest:

Pinterest users shop slow but spend more: People on Pinterest are 35% more likely to take a week to make purchase decisions and spend 2x more per month than people on other platforms.

Most searches on Pinterest are “unbranded”: 77% of weekly Pinners have discovered a new brand or product on Pinterest. Meaning advertisers have the opportunity to influence a shopper before they have made up their mind about what type of brand they want.

Pinterest behavior indicates intent: Pinners are more than 7x more likely to purchase products they’ve saved.

Pinterest can predict the future: People come to Pinterest to plan, which often leads to a purchase. In 2020, Pinterest predicted 100 trends, of which 80% came true.

While I’m a big fan of Pinterest—their commerce potential; not their discriminatory treatment of Black women—I’ve long been critical of their ability to build a native shopping experience. Yes, Pinterest is planning to relaunch on-platform transactions by the end of the year, but it has not been a great place to buy most items. First of all, many of the purchases shoppers plan on Pinterest are for larger items where having the ability to checkout on Pinterest doesn’t meaningfully impact conversion rates. Imagine you’re using Pinterest to remodel your living room. If you’re buying a $2000 sofa you need to see reviews, compare photos, maybe even see the item in person. For lower-cost, impulse purchases, the product has lacked feature parity with other shopping apps. A small example, but the buyable pins product circa 2018 didn’t even have a place where shoppers could enter in coupon codes. For these reasons (and more) shoppers often start planning their purchases on Pinterest but complete those purchases elsewhere.

And that’s exactly the point.

Deconstructing the sales funnel

At its core, Pinterest is more like Google than eBay. It’s a search engine that conducts over 5 billion searches per month for fuzzy, hard-to-describe ideas where pictures, rather than words, are often the best place to start. It also has a growing ads business that produced $613M last quarter, up 125% YoY. With Pinterest, PayPal would be buying the top of the funnel—the awareness and interest stages—for millions of websites on the internet. PayPal would provide Pinterest with the bottom of the funnel, allowing them to see the purchases that result from shopping that began on Pinterest.

Imagine if PayPal could use their core product and the commerce assets they’ve acquired over the past five years to build a deconstructed sales funnel, not just for one website, but for the whole internet.

This is actually the stated goal behind PayPal’s 2019 acquisition of Honey (which cost $4B and everyone thought was crazy at the time). As PayPal put it in their press release (emphasis mine):

Honey will enable PayPal to reach consumers at the beginning of their shopping journeys and will enhance PayPal's ability to help merchants acquire and convert consumers by delivering offers that are personalized, timely, and optimized across channels.

In April 2020, Thomas Paulson, principal and founder of Inflection Capital, published a very compelling proposal for how Pinterest and PayPal could benefit each other in a merger. His main point is that PayPal and Pinterest can form a flywheel where purchase behavior is fed into Pinterest to increase ad relevancy and targeting, which will then lead to more transactions on PayPal. I highly recommend reading the whole thing, but one slide jumped out to me in particular:

If you follow Paulson’s logic, you can begin to see a sales funnel taking shape with Pinterest at the top of the funnel (which is differentiated vs. other search engines like Google), Honey influencing purchases/cart size in the middle of the funnel, and PayPal/Venmo increasing conversion rates at checkout. And all of these assets are spread out across millions of user browsers and merchant websites across the internet. PayPal is trying to own the entire commerce experience, not just for one property, but for the entire internet, which might be necessary to do if Apple has anything to say about ads and commerce on the web.

Competition & ATT

The idea of PayPal assembling a deconstructed sales funnel for the internet is notable in the context of Apple's App Tracking Transparency (ATT) policy, which is starting to squeeze other ad networks out of their primary source of revenue. With these assets all under one $PYPL umbrella, a shopper’s journey from awareness to purchase to loyalty would all be "on-platform,” thus avoiding the ATT cookie restrictions. h/t @ElliotTurn.

It’s very likely that ATT has spurred Google and FB to move aggressively into more “on-platform” commerce. Amazon is building a giant ads business on top of their commerce engine to keep everything in-house. Shopify is going the opposite direction, partnering with every major social platform in an attempt to bring advertising and transactions more closely together. If you host your site on Shopify, you can use their integrations to bypass certain ATT restrictions because it’s all considered first-party data.

At the bottom of the funnel, PayPal’s Braintree has been getting whooped by pure-play payments processors like Adyen, Stripe, and Checkout for the better part of the past decade. And new entrants like Bolt and Affirm are beginning to scale elegant checkout solutions that threaten PayPal’s core business, online checkout via a digital wallet.

Will PayPal buying Pinterest be enough to respond to these competitive threats? I’m not sure. Many of their previous acquisitions haven’t exactly worked out. But it’s a bold move and, ultimately, I applaud their audacity of attempting to build a deconstructed sales funnel for the internet.