Visa, Apple Pay, & The One Card to Rule Them All

Visa’s new products will allow banks to compete with Apple Pay. Plus, remembering Coin and trying to make sense of the Affirm Card.

Apple Pay vs. Banks

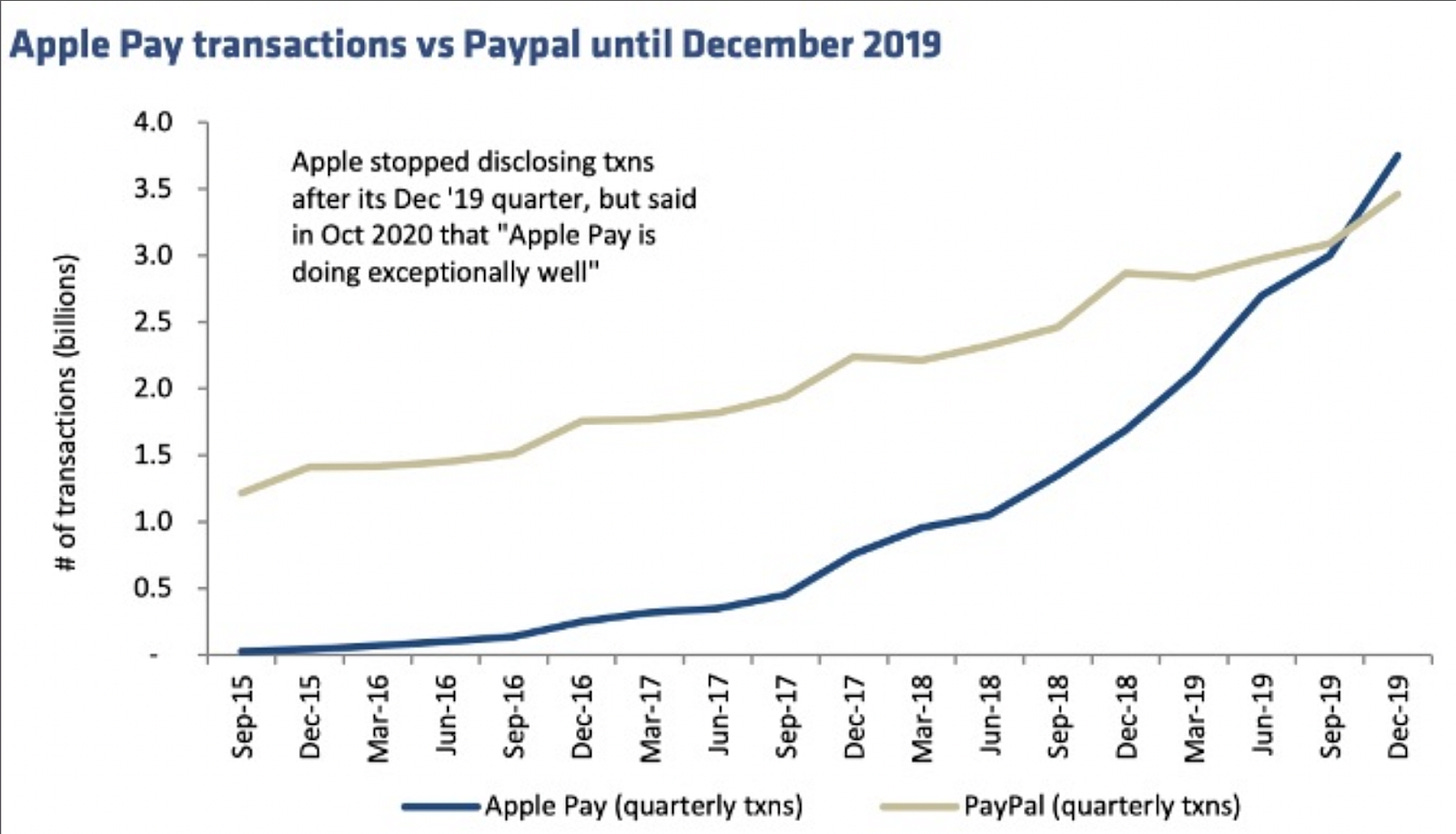

October marks the tenth anniversary of Apple Pay, which had somewhat of a slow start, but by its fifth year was giving PayPal a run for its money:

Since then, Apple Pay has gone on to become one of the most successful consumer payment products in history. Here are some numbers illustrating the scale of Apple Pay, according to research from Capital One Shopping:

640 million people worldwide are Apple Pay users

60.2 million people in the United States are Apple Pay users

Over 90% of U.S. retailers accept Apple Pay

As a result of this scale, Apple Pay is responsible for trillions of dollars of payments volume around the world each year. In 2022, for example, Apple Pay generated an estimated $6 trillion in payments volume and made $1.9 billion of revenue for Apple, according to Capital One’s research. And every time a transaction is initiated via Apple Pay, banks pay Apple 0.15% of the transaction amount. In 2019, Apple launched its own credit card, powered by Goldman Sachs, making it directly competitive with the issuing banks—those that “issue” cards to consumers—it works with for Apple Pay.

Banks are increasingly unhappy with this arrangement.

In 2021, issuing banks appealed to Visa to implement new rules that would reduce the number of fees they pay to Apple, specifically for recurring transactions, according to the Wall Street Journal:

“Currently, banks pay Apple a fee when their cardholders use Apple Pay. Under the planned new process, the fees wouldn’t apply on automatic recurring payments such as gym memberships and streaming services.”

In response, Visa introduced a technical change based on it’s network token service that would be more favorable to merchants:

“Visa shared its planned technical change with at least some banks in recent months. A document reviewed by the Journal that explained the new process didn’t mention the fees but detailed a change to so-called tokens that Visa issues for mobile-wallet payments.

When consumers load their credit card onto Apple Pay, Visa issues a special token that replaces the card number. That allows the card to work on Apple Pay and also helps keep the card secure in a potential data breach, among other benefits.

Visa plans to start using a different token on recurring automated payments. That effectively means that after a first payment is made on a subscription, Apple won’t get fees on the following transactions.”

Finally, earlier this year the Justice Department filed a lawsuit against Apple, suggesting that “banks have been victims of Apple’s antitrust infractions, noting that fees the banks must pay when consumers use credit cards are ‘a significant new cost,’” according to a March 2024 article by James Pothen at PaymentsDive. Now, framing the same financial institutions that make billions of dollars each year in overdraft fees as ‘victims’ is a bit rich but the point remains that issuing banks have been seeking a white knight to help them fight back against Apple Pay1.

Visa’s New Products Will Allow Banks to Compete with Apple Pay

It’s within this context that Visa announced a suite of tools at its Payment Forum in San Francisco last week that will help issuing banks more easily build Apple Pay-like consumer experiences. In an interview with PYMNTS’ CEO Karen Webster, Mark Nelsen, Visa’s senior vice president and global head of consumer payments, indicated that many of the company’s recent product announcements were aimed at helping its bank customers meet increasing consumer expectations with more “competitive authority”:

“Nelsen emphasized that the new products and services are built for the entire payments ecosystem but give issuers new capabilities to turn their mobile banking apps into digital payments and commerce focal points. Yet with the competitive authority to now play more fully in the digital wallet ecosystem, Nelsen said that consumers will also expect more from their banks. He believes the seven products Visa is launching today will give them a strong foundation upon which to innovate the consumer experience.”

There were three products Visa announced, which I believe will help banks compete with Apple Pay:

Visa Payment Passkey Service + Click to Pay + Tap to Everything

One of the benefits Apple Pay has held over other types of consumer wallets is the ability to authorize/initiate transactions via fingerprint or facial scans using a consumer’s phone, leading to lower fraud and dispute rates and as a result higher authorization rates. In response, other digital wallets like PayPal have implemented passkeys—an open standard maintained by the Fast Identity Online (FIDO) Alliance that uses on-device biometrics scans to securely login to accounts—to bring a similarly secure and convenient payment option to even more consumers. This is an example of good payments infrastructure that is most useful when deployed at scale so Visa implementing passkeys at the network level is the next logical step and the industry will be better for it.

Visa’s marketing materials imply that Visa Payment Passkey Service will only be available via Click to Pay, Visa’s proprietary online checkout experience, which is primarily deployed outside the US, but here’s how Visa’s Mark Nelsen described a potential implementation in the US to PYMNTS:

“For US consumers, what they would be able to expect is when you’re buying something online have more of those transactions go through seamlessly and not have to get a call from your bank saying ‘hey, I need you to confirm your identity’...what this will end up doing, if you do the facial scan immediately up front, which as you know only takes half a second, you can do that real quick check which means all of these transactions will go through seamlessly and you no longer have to confirm your identity after the fact.

When asked how consumers will obtain passkeys, Nelsen said:

“You’re in your mobile banking app and your bank just simply says ‘hey do you want to create a passkey to make payments online easier?’ You just consent and that’s it. At that point in time Visa creates a private key and we put it on the consumer's device and when you now use that device for payments that key is going to create a digital signature so the bank knows that this is you.”

Visa also said that it “will partner with issuers to enable Click to Pay and Visa Payment Passkey Service on new Visa cards, reducing manual entry of card details and passwords from the moment the card arrives.” Visa’s Tap to Everything capabilities also provide the convenient experience of simply tapping a card to a device to automatically load your card details, but it’s the new Tap to Confirm functionality that brings an additional layer of security to transactions by allowing consumers to “use a card to authenticate identity for online shopping by tapping their card against their mobile device.”

Taken together, these capabilities effectively give enterprising issuing banks (including neobanks using the appropriate issuing processor and sponsor bank) an SDK to build convenient and secure consumer payment experiences like Apple Pay or Google Pay.

Before we get too carried away, Fintech Brainfood’s Simon Taylor points out that “Visa has a history of announcing things like wallets that never catch on.” But, like network tokens—of which Visa now has over 4 billion in circulation—passkeys and Tap to Confirm are a security boon to the industry so I’m bullish they’ll catch on. For a complacent, rent-seeking monopoly, Visa sure did ship a lot of useful new products last week.

Remember Coin?

Now let’s talk about a less useful product..

Almost a decade ago, I worked with a lot of crowdfunding campaigns and learned a universal truth about the human condition: people really hate their wallets. More specifically, people seem to resent carrying around multiple cards in their wallets every day. This sentiment has resulted in over 2,200 wallet campaigns on Kickstarter in the last five years alone, according to LaunchBloom, and a decade ago, “slim wallet” campaigns were so prevalent on Kickstarter that the crowdfunding platform felt compelled to publish a deep dive explaining why these projects kept popping up.

In November of 2013, the mother of all “I hate carrying multiple cards” crowdfunding campaigns launched, surpassing its $50,000 funding goal in just forty minutes. But the product wasn’t a wallet at all. It was Coin, a single “connected card” that could store the payment details of up to eight different cards on a single swipeable, battery powered device. Most users were excited by the idea of being able to slim down their wallet while others liked the ability to pay with different cards easily at different merchants, presumably to maximize rewards and cash-back.

A year after Coin launched, Apple Pay was introduced. Today, with just a phone, users can pay with a tap at almost any merchant and switch between different cards seamlessly. Users don’t need a wallet at all. Apple Pay more elegantly solved the problem Coin set out address (fewer cards in your wallet) by going a level deeper in the stack (phone operating system vs. a card) and riding the wave of some structural changes in the payments ecosystem that the payment networks rolled out around the same time:

Visa and Mastercard introduced token services in 2014, allowing for payment information to be more securely transmitted for payments initiated from digital wallets like Apple Pay

New fraud liability rules took effect in 2015 that accelerated the adoption of chip-enabled cards, which Coin didn’t support

Contactless cards—which Apple Pay massively benefitted from / helped spur the adoption of—were introduced by Visa in 2018

Take all of those structural forces working in Apple’s favor, add in Apple’s massive distribution advantage, and it’s obvious that Coin never really stood a chance. Indeed, Coin was acquired by Fitbit and eventually shut down in 2017.

Visa Flexible Credentials: The One Card to Rule Them All, Maybe

The spiritual successor to Coin is Visa’s new Flexible Credentials, which they also announced at the Payment Forum last week. Flexible Credentials are “a new technology that lets issuers give their clients the ability to access different funding sources on an existing payment card,” including lines of credit, checking accounts, loyalty points, prepaid debit, installments, and maybe even stablecoins. Although the list of funding sources includes some modern additions (i.e., crypto and BNPL), the product itself seems to have been inspired by decade-old products like Coin. I mean just look at the marketing materials:

This copy, in particular, could have been pulled straight from Coin’s crowdfunding website:

“For each line of credit, checking account or prepaid balance at your disposal, you need a separate card. This means a lot of us—for a long time—have carried around a small stack of plastic.

In the not-too-distant future? Wallets are in for a slimdown. New, flexible credentials map multiple funding sources to a single card — virtual or otherwise.”

Referring to products like Coin in her PYMNTS interview, Karen Webster joked about Flexible Credentials replacing “the bad old days of those battery powered plastic cards, with those little buttons.” She went on to say that products like Coin were “the birth, really, of the idea of having lots of different card capabilities inside of a single card.”

Just like Apple Pay was able to create a more elegant solution than Coin by going a level deeper in the technology stack, Visa seems to be empowering Apple Pay competitors by implementing Flexible Credentials at the payment network level. Here’s the future Visa’s former SVP and Global Head of Fintech, Terry Angelos, believes is in store for consumers using Flexible Credentials:

“Now the 16-Digits can be mapped to multiple products and the “terms of service” resolved in real-time by the customer at the POS. We now have a pointer to multiple [Bank Identification Numbers] (BINs) and the consumer can choose:

Fuel Tap = Shell rewards debit card

Grocery Tap = Amazon Prime for 5% back

United Airlines Tap = Mileage Plus Credit Card

Restaurant Tap = Sapphire Reserve please

Note that the acquiring ecosystem of processors and terminals will need to be upgraded to support these dynamic BINs (which is why these flex credentials only operate in markets like Japan for now).”

If this future comes to pass, I would expect companies like Kudos, which just raised a $10 million Series A, to issue its own physical card that abstracts away all of a user's other cards as it decides—on the fly—which card should be used for each transaction. I would also expect companies like Curve to finally launch in the US. This is an exciting and competitive vision of the future that will benefit consumers.

Unfortunately, while Coin and Apple Pay allow cards from multiple different banks to exist side by side in a single device or wallet, Visa seems to envision Flexible Credentials as a product that consumers will use mainly through a bank’s mobile app (vs. a fintech’s app). Here’s how Nelsen described the potential consumer experience:

“You go into your banking app and the bank could say to you ‘hey, we’re allowing for more control and flexibility in terms of how do you want to pay.’ For a consumer, maybe you want to pay on debit, so in real-time, for transactions that are less than $100. And maybe if it's over $100 you want to put it onto a credit line.”

Will banks build apps that allow users to add multiple Visa cards issued by other banks (e.g., BofA allows users to add a Citi card)? What about Mastercard? Visa and Mastercard did announce network token interoperability back in 2016. Will that work here as well?

Is the Affirm Card the Future of Flexible Credentials?

I have a lot of questions about Flexible Credentials, so I looked more closely at the only product I could find using these capabilities in the wild: the Affirm Card.

Affirm worked with Visa, Evolve Bank & Trust (yes that Evolve), and issuing-processor Marqeta to create physical cards that allow consumers to pay via debit or Affirm-provided credit. Marqeta CEO Simon Khalaf confirmed on Twitter that the different funding sources operate under multiple BINs (one for debit and one for credit), but are those from the same issuing bank? Affirm CEO, Max Levchin’s tweets indicate that Affirm’s credit capabilities can be added alongside flexible debit cards issued by different banks, but at this point I really can’t determine how this all works and will have to wait for more information.

If you have more technical details on how Visa’s Flexible Credentials or the Affirm Card works, please email me at info@batchprocessing.co or comment on this post below.

While we’re here, let’s take a look at how the Affirm Card is doing to see if this is an exciting version of the future for consumers: Affirm Card GMV was up nearly 2000% YoY, based on the company’s most recent earnings report—a good sign.

But compared to Cash App’s Cash Card, it’s clear the Affirm Card has a long way to go to gain mass adoption:

The Affirm Card had over 1 million active annual cardholders in the three-month period ending March 31, 2024 (Affirm’s third fiscal quarter), compared to 24 million monthly active Cash App Card users.

Affirm’s active annual cardholder count grew at 30% QoQ, while the Cash App Card grew 16 YoY.

I know these are not apples-to-apples metrics becasue Affirm’s reporting on the Affirm Card is limited right now, but there are signs of life (granted, this is growth from a small base). Still, the Affirm Card is not the world-beater I would have assumed given all the excitement around Coin a decade ago and Flexible Credentials last week.

We’re going to have to wait for Visa to clarify how fintech companies can build new experiences using Flexible Credentials. Until then, we can all continue to use Apple Pay or do our best George Costanza impressions.

A final thought on a dynamic situation, which I wasn’t able to weave into this piece: Jason Mikula of Fintech Business Weekly has been doing impressive work covering the Synapse/Evolve saga. I highly recommend checking out his reporting. My main takeaway is that the For Benefit Of (FBO) bank account structure and the Banking-as-a-Service model—two innovations which have powered the past 15 years of fintech—are under serious risk. Will the future of fintech come down to Visa-empowered legacy banking apps vs. big tech fintech products like Apple Pay?

This batch was powered by:

To be fair, Visa itself is under DOJ investigation for how it prices its network tokens

Visa's product seems very much focused on helping issuers try and keep cardholders within that issuer's ecosystem. Which makes sense given Visa's clients are the issuers. One interesting angle is how this shapes up competition. Cardholders may become used to being able to flex between different products, therefore it may be in an issuer's interest to offer a wider range of products both in terms of the baseline various debit and credit options, but other options too. For instance, if a transactions if over X amount then use credit, but if it's over a higher amount then use BNPL with debit, and another higher amount then use BNPL with credit (essentially BNPL with credit having the capability to push back the repayments by another 30 days). Or banks may be interested to parter with fintechs to build more interesting products into their existing stack. It could be an interesting case of compete and co-operate between banks and fintechs. One thing is for sure, the US payments market on the consumer side could be about to get even more competitive!

Before Coin, there was Wallaby, which I started in 2011 with intelligence to do specifically this kind of routing. I am an investor in Kudos because I believe it will be able to achieve some of those goals. The irony is that Visa's "innovation" team nixed our Wallaby idea because the network will never allow someone to ride over the top of the rails and choose between issuers–because issuers don't want that.