Worldpay’s M&A Strategy and The Future of PayPal is Braintree

Worldpay is just a collection of payment M&A deals in a trench coat. Lots of management changes at major payment companies. Braintree and Venmo show up, again, as the main growth drivers for PayPal.

The “trench coat” theory of Worldpay’s M&A strategy

FIS, a multinational payments and banking technology company, announced that it will be marking down and spinning out Worldpay, Inc., its payments division that it acquired for $43 billion in 2019. The standalone entity is estimated to be worth about $25 billion after a $17.6 billion “goodwill impairment,” and Worldpay plans to reaccelerate its weak revenue and payments volume growth via acquisitions. That all sounds like good corporate governance. There’s only one problem: Worldpay is actually just a dozen payment companies in a trench coat pretending to be a single payments technology platform. Said another way, I don’t think their merger and acquisitions (M&A) strategy will work.

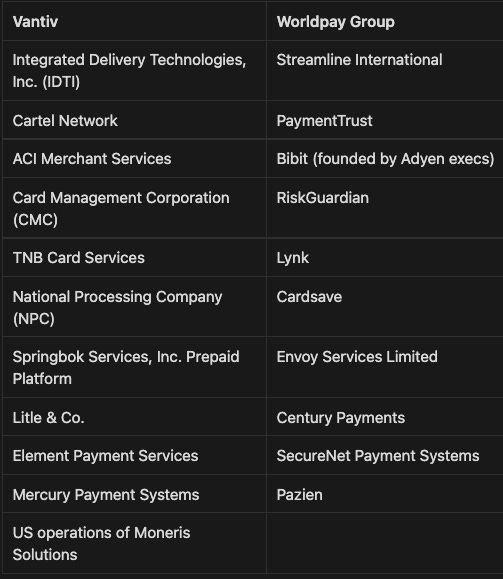

Worldpay is the final boss of payments M&A. The company is the result of a $10+ billion merger between U.S.-based Vantiv and UK-based Worldpay Group in 2017. Vantiv was the merchant services division spun off from Cincinnati-based Fifth Third Bancorp in 2009. London-based Worldpay Group was spun out of the Royal Bank of Scotland in 2010. Those companies were, in turn, the result of more than a dozen smaller M&A deals, starting in the 1990s. Here is an incomplete list of all the companies each entity acquired before their merger:

Sometimes the acquisitions were motivated by bringing new capabilities into the company. Sometimes they wanted to reach new regions. Sometimes they were just buying a book of merchant volume. Regardless, the result seems to have worked. From Vantiv’s 2018 full-year results:

For the full-year 2018, net revenue increased 85% to $3,925 million as compared to $2,123 million in Vantiv Inc.'s prior year. Had the Company's acquisition of Worldpay Group plc closed on January 1, 2017, net revenue would have increased by 10% on a pro forma basis and by 9% on a pro forma constant currency basis, when excluding $36 million in foreign exchange tailwinds.

The Vantiv/Worldpay Group merger helped the business grow massively and Worldpay became the world’s largest merchant acquirer as measured by number of transactions. Previous acquisitions, like Vantiv’s acquisition of Mercury Payment Systems, did the same:

For the full-year 2015, Merchant Services net revenue increased 25% to $1,336 million as compared to $1,067 million in the prior year, primarily due to a 17% increase in transactions and a 7% increase in net revenue per transaction. The Mercury acquisition was completed during the second quarter of 2014. On a pro forma organic basis, Merchant Services net revenue would have increased 14% for full-year 2015 as compared to the prior year if we had owned Mercury throughout both years. [source]

While all those acquisitions have provided growth as measured by total payments volume (TPV) and net revenue, they have also created friction for companies attempting to access Worldpay’s capabilities.

Here’s a simple example to illustrate my point about integration friction. Say you’re a retailer that wants to use Worldpay to accept online payments in the US and the UK. Should be easy, right? Well, you can choose from Vantiv eCommerce (formerly Litle & Co.) or Vantiv Express (formerly Element Payment Services) but they are US-only. You could also use WorldPay US in the US but it’s not exactly clear why you’d use that API instead of the other two. For the UK, you’ll need to use Worldpay’s UK-based capabilities, which support SEPA bank transfers, which are popular there and not available via the other APIs mentioned so far. For each integration, there are different endpoints (URLs) to communicate with the API host and different authorization headers needed to authenticate your API requests. And when Worldpay releases a new version of their API documentation (like replacing instances of ‘Litle’ with ‘Vantiv’ in response messages), you’ll need to update how you interact with the API to handle that or risk your integration breaking. Accessing in-person payments requires integrating with additional environments. Litle for example, is for ecommerce only and there’s a different Vantiv system for card-present payments.

So imagine Worldpay, Inc. is a very tall gentleman wearing a trench coat. You approach the man hoping to introduce yourself only to realize that he’s actually several children sitting on each others’ shoulders pretending to be an adult. Instead of maintaining the illusion that it’s just one very tall adult when you reach out to shake their hand, Worldpay opens up the trench coat and you have to shake hands with each individual kid.

The idea behind the FIS-Worldpay tie-up was for each entity to cross-sell banking and merchant acquiring services to the other’s customers. But that hasn’t worked and Worldpay’s growth has been weak in recent years. So, it’s going back to basics with the express goal of re-invigorating growth via “capital allocation.” They want to go back to buying companies to fuel growth. I just don’t think the strategy will work because every time Worldpay buys a new company, they make the problem I described above worse. They are just stacking another kid under the trench coat.

The founders of Adyen sold their previous company, Bibit, to RBS WorldPay in 2004 and have seemed to have internalized the “benefits of a single platform,” essentially vowing to never acquire another company. Stripe is much more acquisitive but they go out of their way to abstract away the differences of the underlying technology in their API. As a result, many newly formed companies are choosing Stripe over Worldpay from the start while many larger companies are deciding to switch from Worldpay to Adyen.

To manage the business FIS has pulled Charles Drucker out of retirement. Drucker led Vantiv from 2004 through the spin out by Fifth Third Bancorp in 2009 to the FIS acquisition in 2019. He was the chief executive greenlighting most of Vantiv’s previous acquisitions so he certainly seems like the right man for the job given Worldpay’s M&A strategy.

Management changes at major payments companies

In addition to Charles Drucker coming out of retirement to lead the new and improved Worldpay, here are a few other management changes at major payment companies that have been revealed in the past few weeks:

Visa has a new CEO, Ryan McInerney, as Al Kelly (CEO since 2016) steps down. McInerney previously served as the payment network’s president since 2013.

PayPal announced that longtime CEO, Dan Schulman will be stepping down at end of 2023. Schulman has been running the payments company since 2015 when it spun out from eBay.

Fiserv renewed CEO Frank Bisignano’s contract for an additional five years. Bisignano has been the CEO of First Data since 2013. When First Data was acquired by Fiserv in 2020, Bisignano became CEO of the combined entity.

Adyen's long-serving CFO, Ingo Uytdehaage, will be stepping into a co-CEO position alongside Pieter van der Does. Pieter has been dealing with some health issues that have kept him out of the company’s Amsterdam office in recent months. Ethan Tandowsky, who has run Adyen’s finance group for the past few years will step into the CFO role. Kamran Zaki, who served as Adyen’s COO for the past three years and as President, of North America for several years before that will be leaving the company this summer.

Stripe has announced that CFO Dhivya Suryadevara is departing to attend to family matters. Suryadevara served as GM’s CFO from 2018-2020 and Stripe’s CFO from 2020-2023. Will Gaybrick, who served as CFO from 2015 to 2018, and was most recently the Chief Product Officer, will become President - Product, Business.

Checkout dot com has appointed its former CFO, Céline Dufétel as President (while retaining her COO responsibilities).

Mollie, a Dutch payments company, has promoted CTO Koen Köppen to the CEO role after just 5 months with the company. Köppen, who was formerly CTO at Klarna, replaces Shane Happach, a Worldpay veteran who had replaced Gaston Aussems as Mollie CEO in 2021. Aussems himself, replaced founder Adriaan Mol as CEO in 2013. Lots of CEOs...

Braintree is the future of PayPal

It’s a new day at PayPal! Their Q4 2022 results show that, yet again, Braintree is driving meaningful payments volume growth for the company. From PayPal’s Q4 2022 investor update:

13% growth in payment transactions per active account (TPA) was predominantly driven by transaction growth from Braintree

Transaction revenue grew 5%, driven primarily by Braintree.

Based on this update, we can estimate that Braintree (”unbranded processing) is responsible for $408B of PayPal’s total payments volume (TPV) and growing at 40% YoY. That’s 100x the payments volume it processed when it was acquired by PayPal a decade ago and in spitting distance of modern payment processing peers, Adyen ($820B TPV, 49% YoY growth) and Stripe (est. $768B at 20%-30%). Meanwhile, peer-to-peer payments volume—a key user acquisiton tool for services like Cash App—for Venmo grew 7% and PayPal’s P2P volume actually declined YoY.

Departing PayPal CEO, Dan Schulman has spent the past decade leading the company toward "enhanced consumer choice," which means that card volume on PayPal (vs. digital wallet volume) has increased. Without the prominence of the PayPal wallet, there’s more opportunity to sell “unbranded processing” to merchants and platforms, while offering exclusive, native integrations into PayPal and Venmo as checkout options that increase conversion. One exciting vision for the product could be offering a Shop Pay-like checkout experience to merchants that uses the on-file information of shoppers in the Venmo and PayPal ecosystem. PayPal is already experimenting with these things via PayPal’s Branded Checkout but could make elements of this available via Braintree as well. If I were running the show, I’d split PayPal into two divisions: Braintree and Venmo, and put someone like Alyssa Henry or Sarah Friar from Block in charge as the new CEO.

Stripe Can’t Lose

Last week, I wrote an essay about Stripe’s early innovation, increasing competition, and questionable capital allocation for Every—a writer collective focused on business. The essay is now available, in its entirety, on Batch Processing.

Cutoff Time

Cutoff Time is a section of Batch Processing that includes interesting links to news or ideas that caught my eye but decided not to write about in this batch:

PayPal’s Buy Now, Pay Later (BNPL) product seems to be doing well (slide 9) compared to Affirm, which has much greater mindshare in the BNPL industry. PayPal bought Bill Me Later and offered a product called “Pay in 4” until 2020 so they weren’t starting from scratch but the usage numbers are still impressive.

The global fraud rate went down by 25% during Q1 of 2022, mainly due to security upgrades performed by financial institutions, and consistent implementation of fraud prevention tools and practices. One of those tools is the statement descriptor.

Stripe’s expenses were as high as $500 million in 2022, per The Information.

Adyen’s earnings were good. The stock decreased 15% after hours.

I cannot, for the life of me, find Fiserv’s merchant acceptance total payments volume in its most recent earnings. Can anyone help?

This batch was powered by:

Do you think WorldPay had a vision to consolidate all these acquisitions into one technical infrastructure? If so, what caused each technology/service to remain so independent under the hood?

Any good commentary out there on why Adyen's stock got hit after these earnings? https://twitter.com/jkwade/status/1623363821053087762?s=20